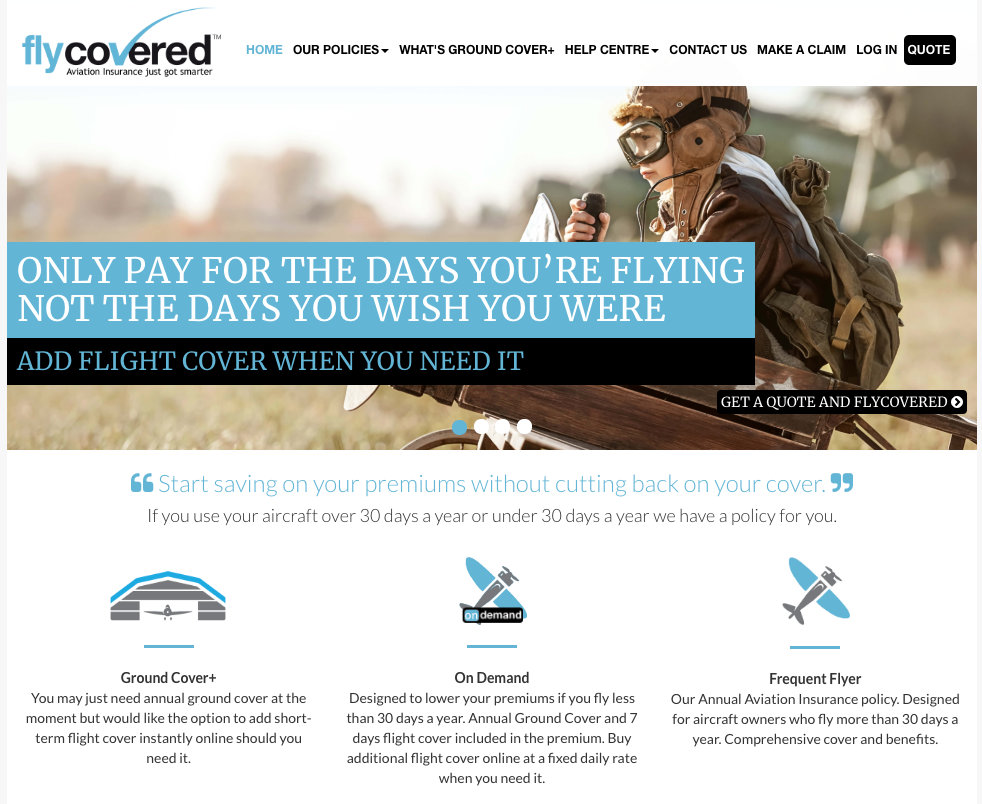

- Discover a faster and more efficient way to present your existing products online.

- Transform your existing or new insurance products into dynamic offerings that set you apart.

- Picture the advantage of outpacing competitors by not just focusing on price but also providing your customers with a range of choices.

- Imagine the impact of offering true choice and flexibility in insurance, redefining your customer’s experience, and giving your customers the ability to manage their policies 24/7.

- Saving money is as important as making it. Our platform is designed to be a cost-effective solution, eliminating unnecessary expenses associated with manual errors, delays, and inefficient processes.

About Covered

With over 60 years of combined experience in the fields of insurance and information technology, our team has consistently demonstrated innovation in insurance. Here are some key highlights of our achievements:

- Pioneered the development of the first Annual On-Demand Aviation, Drone, and short-term Learner Driver Insurance solutions.

- Successfully delivered over 10,000,000 hours of On-Demand insurance to a customer base, exceeding 55,000 On-Demand customers.

- Processed more than 200,000 On-Demand transactions (as of the latest data snapshot on 01/12/2023), showcasing our robust and efficient systems.

- Administered and delivered over 150,000 policies through our cutting-edge in-house platform, ensuring a seamless experience for our clients.

- Based in Essex and Oxford, our locations enable us to provide personalised services to clients across regions.

- Operate under Directly Authorised regulatory status, exemplifying our commitment to compliance and transparency.

- Forged strong relationships with reputable insurers, including Tokio Marine Kiln and KGM, to offer comprehensive coverage and unparalleled service to our clients.

- Our IT platform is used by a leading insure to deliver insurance products to its coverholders around the world

Our Platform

Benefit

Innovative Insurance Credit Mechanism: Our platform employs a sophisticated system utilising insurance credits, delivering unparalleled flexibility in tailoring coverage durations to individual preferences.

Compatibility Across Insurance Sectors: Designed for seamless integration, our platform adapts effortlessly to most insurance sectors and can offer a comprehensive solution for specialised coverage needs.

Immediate Coverage for Dynamic Sectors: In response to the fast-paced nature of gig and sharing economy, our platform can ensure swift coverage for freelancers and collaborative participants.

Intuitive and Secure User Interface: Our platform delivers the insured with a secure and user-friendly interface. This facilitates effortless management and modification of coverage at the convenience of the policyholder.

Real-time Communication for Stakeholders: Our platform excels in delivering real-time updates, ensuring administrators and insurers receive prompt and relevant information.

Differentiate yourself from your competitors

Product demo videos

FlyCovered Frontend Highlights that can be utilised in any product offering.

- Own CSS

- Own top and tail

Template Based

- Full control of content if needed

Cached output

- Content is cached by NGINX server

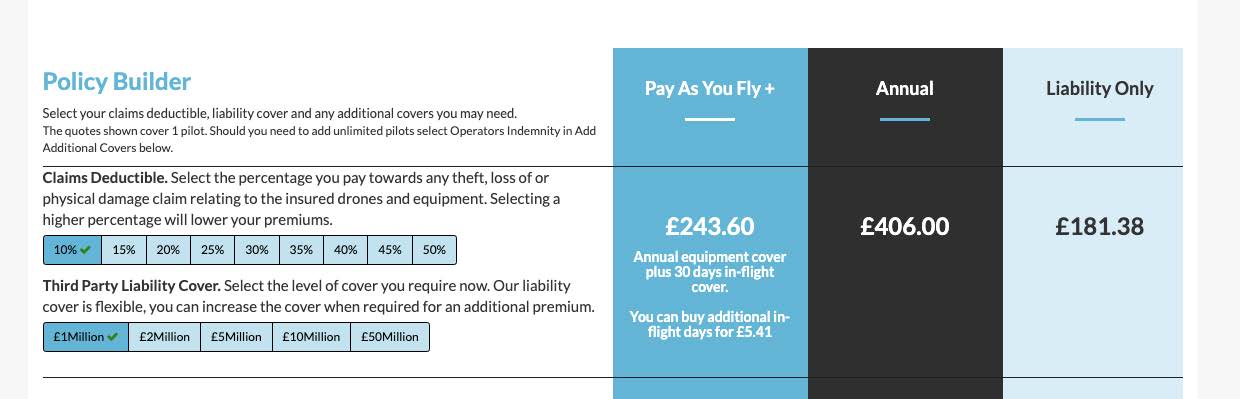

Policy Options

- Multiple policy options can be offered from one question set

FlyCovered

Frontend Highlights

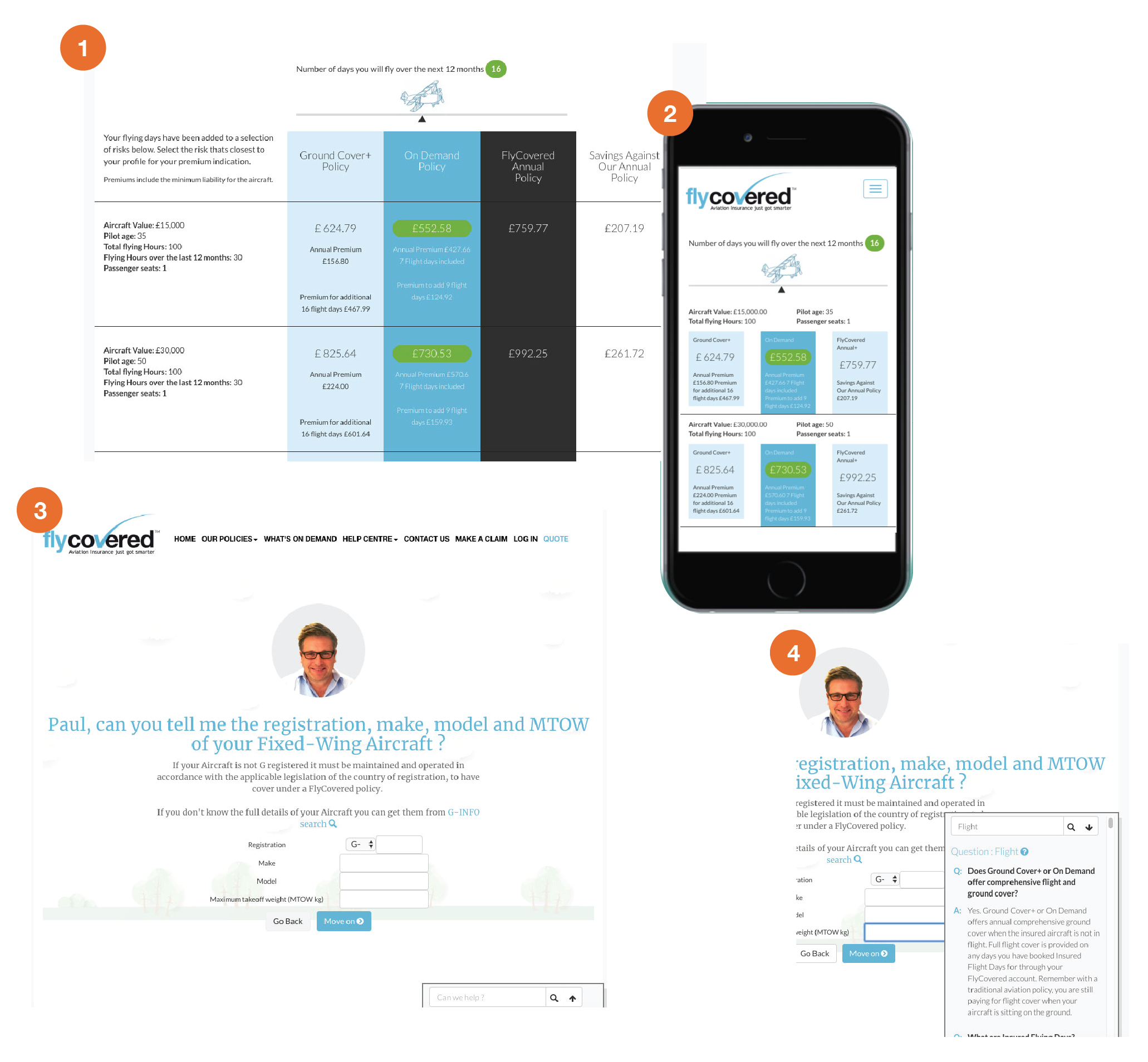

1.

High speed premium indication

Moving the slider gives 8 premium indications

against a selection of risks

2.

Additive design

Design will adapt to make the best use of the

screen resolution of the device

Host guides you through the questions

4.

User can ask for help at anytime even during the quote. Questions are linked to the help centre. System keeps the input screen clear.

FlyCovered

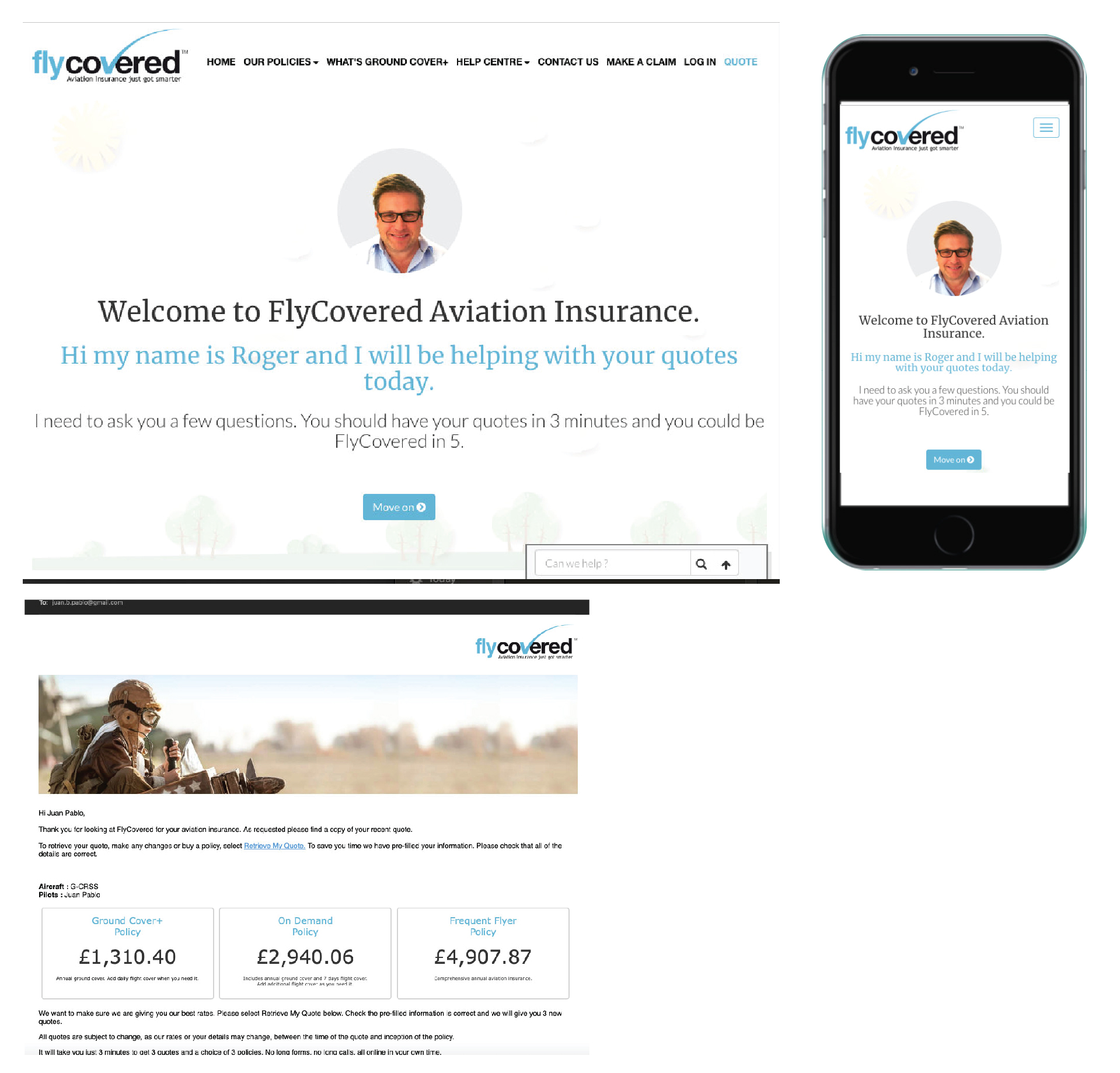

Frontend Quote

Fast ‘Quote and Buy’

Lighting fast and scalable. Quote in 3 minutes covered in 5

Multiple active rates

Rates can be linked to territory or product

Question change real time

FlyCovered

Ecoms System

FlyCovered

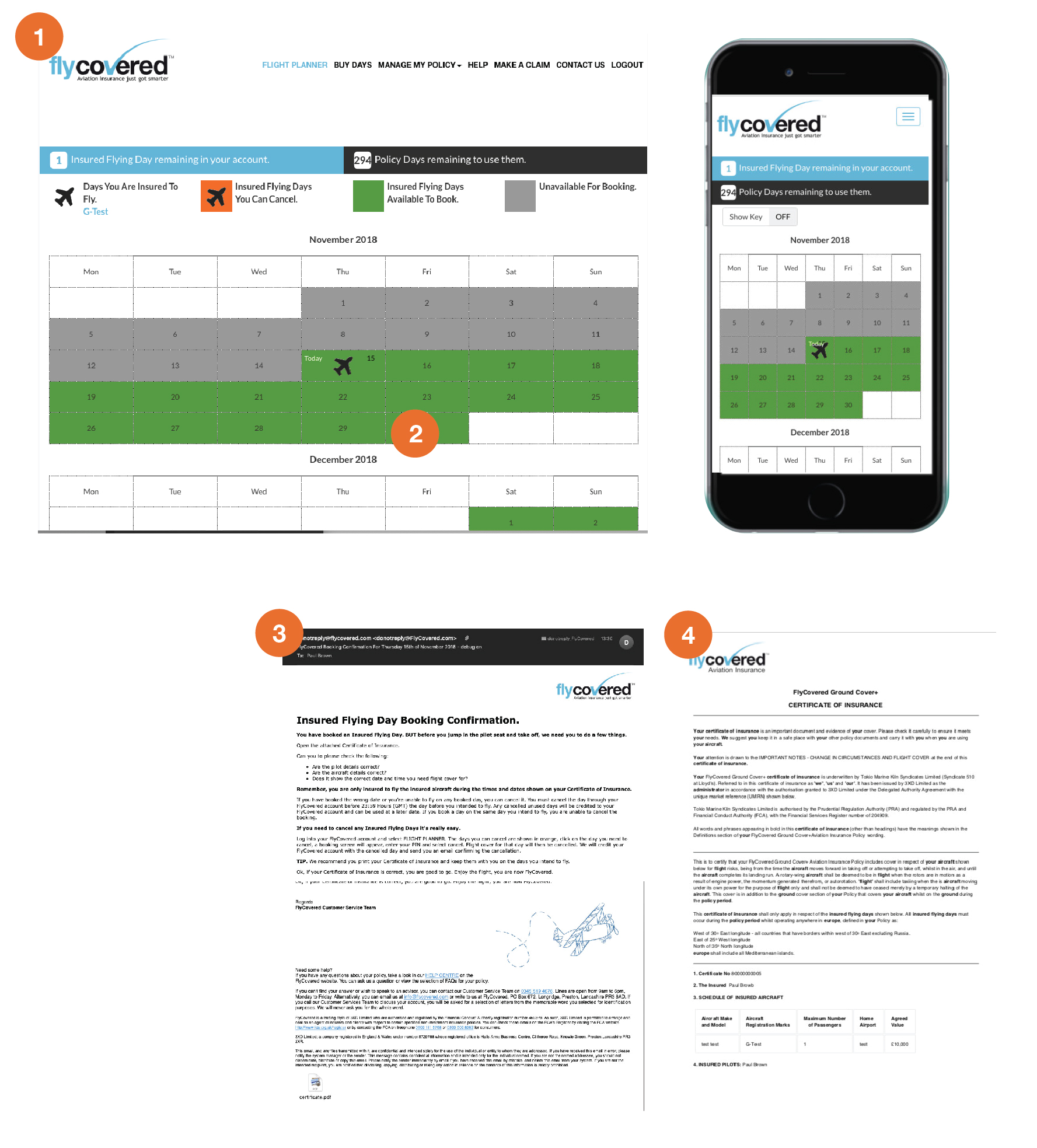

Policy Booking

1.

Booking

Book on laptop, tablet, phone all

secured with a pin number

2.

Cancelations

Booked days can be cancelled with pin

number

Secure email

Emails sent via API to sendgrid

4.

Dynamic PDFs

Schedules and certificates

FlyCovered

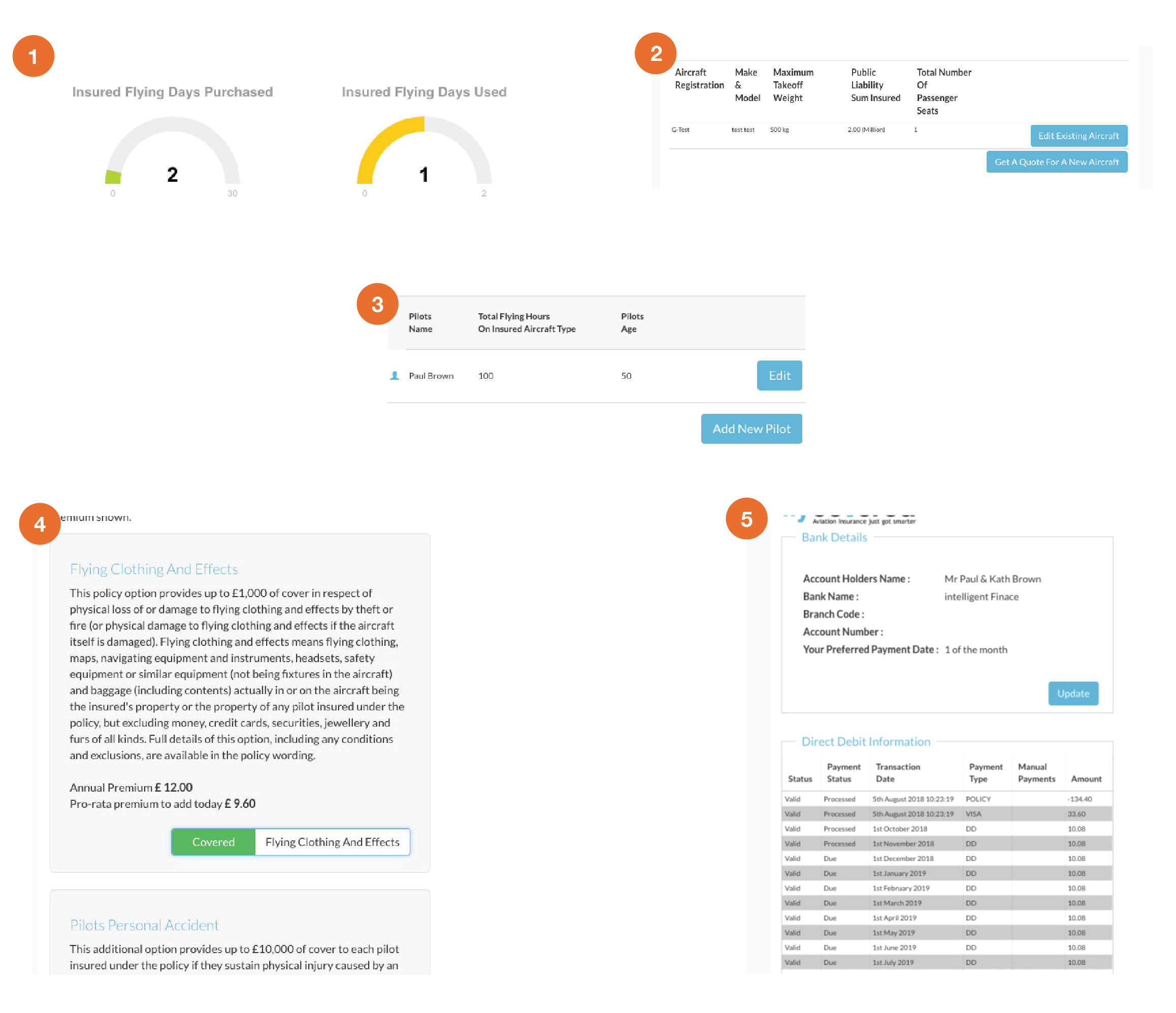

Policy Management

1.

Dashboard

Policy summary, access to schedule

and certificates

2.

Craft maintenance

Add, update, delete

Pilot maintenance

Add, update, delete

4.

Add-on’s maintenance

Add, update, delete

Bank information

Update bank details, view premium

payments

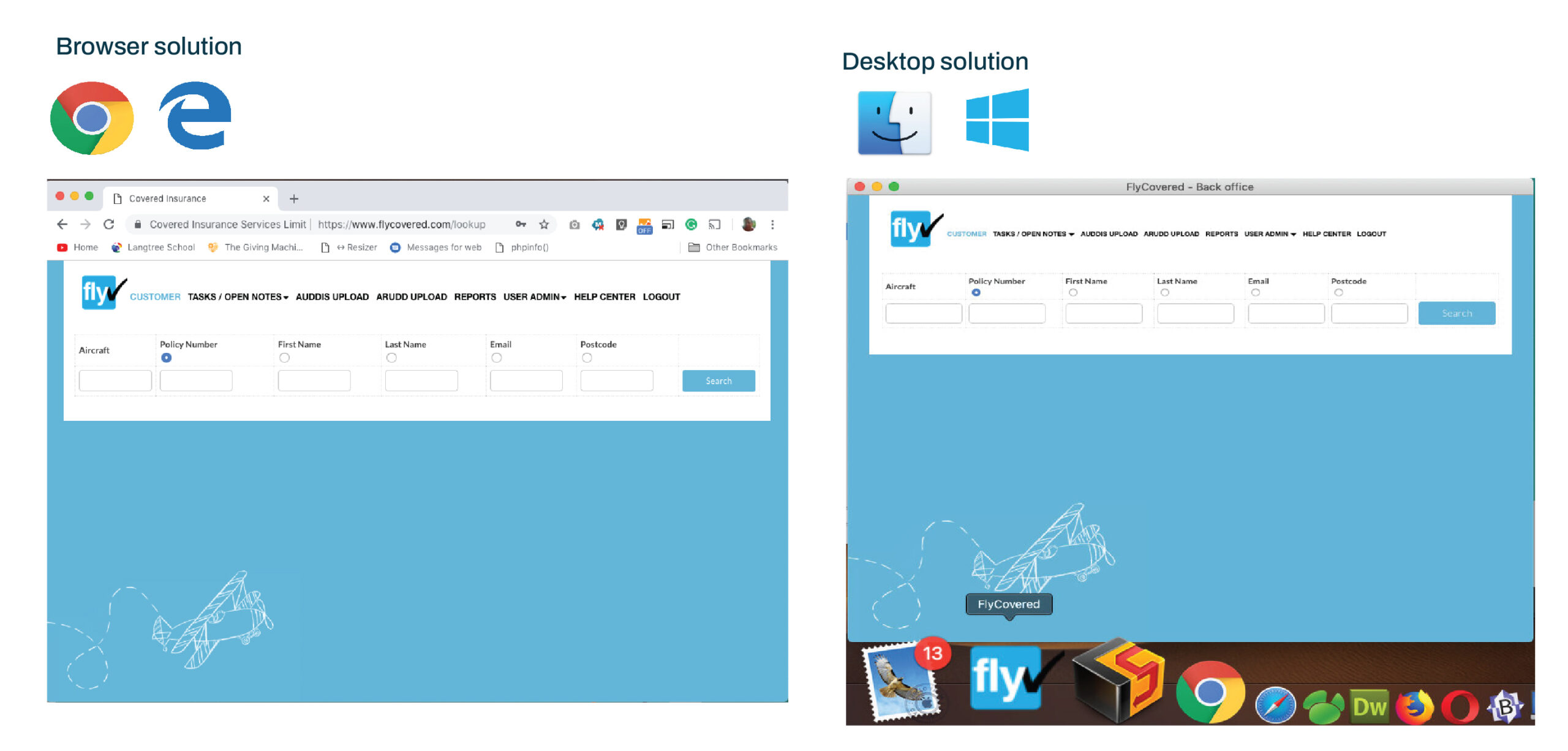

FlyCovered

Broker Backend

FlyCovered

Broker System

FlyCovered

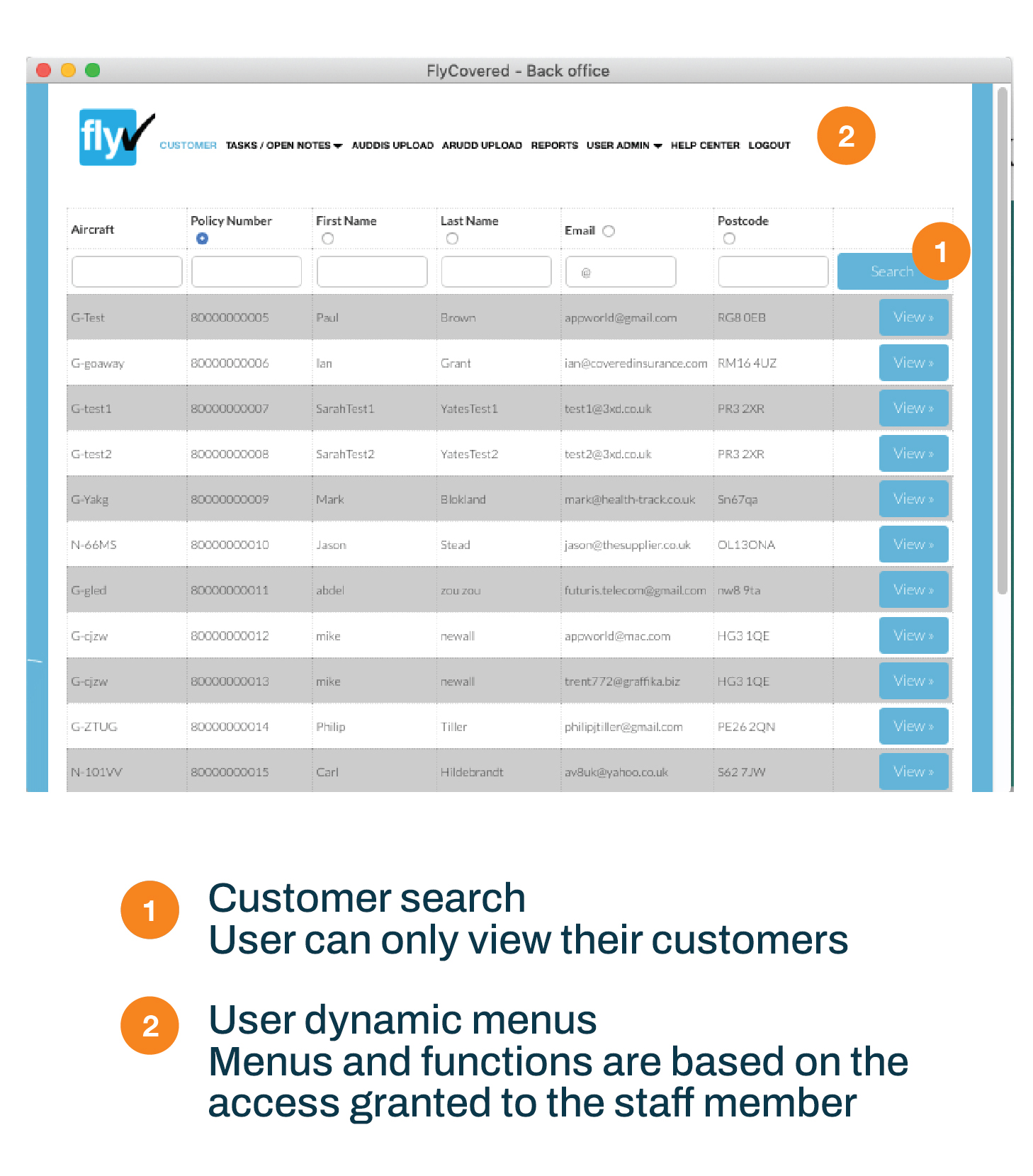

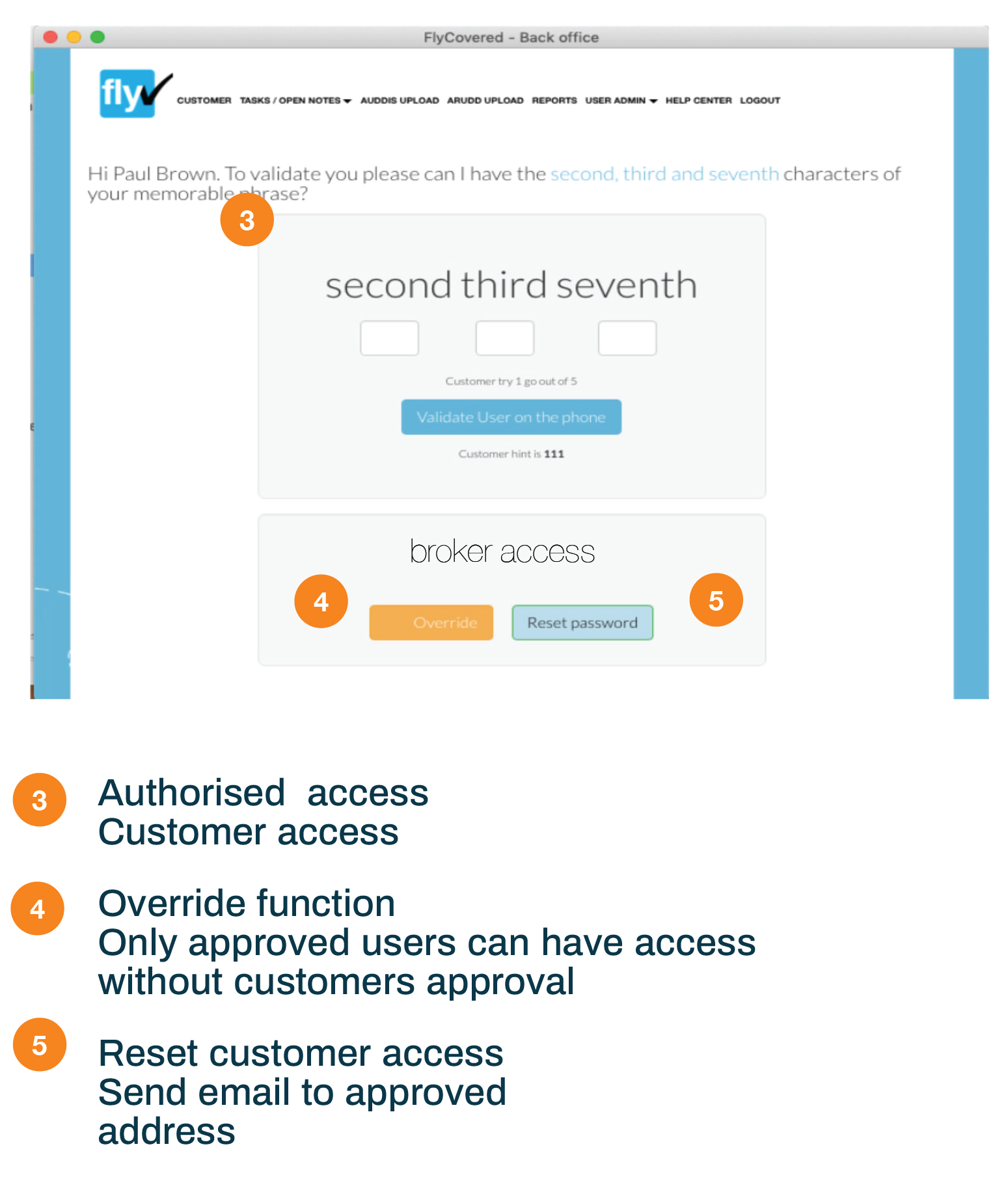

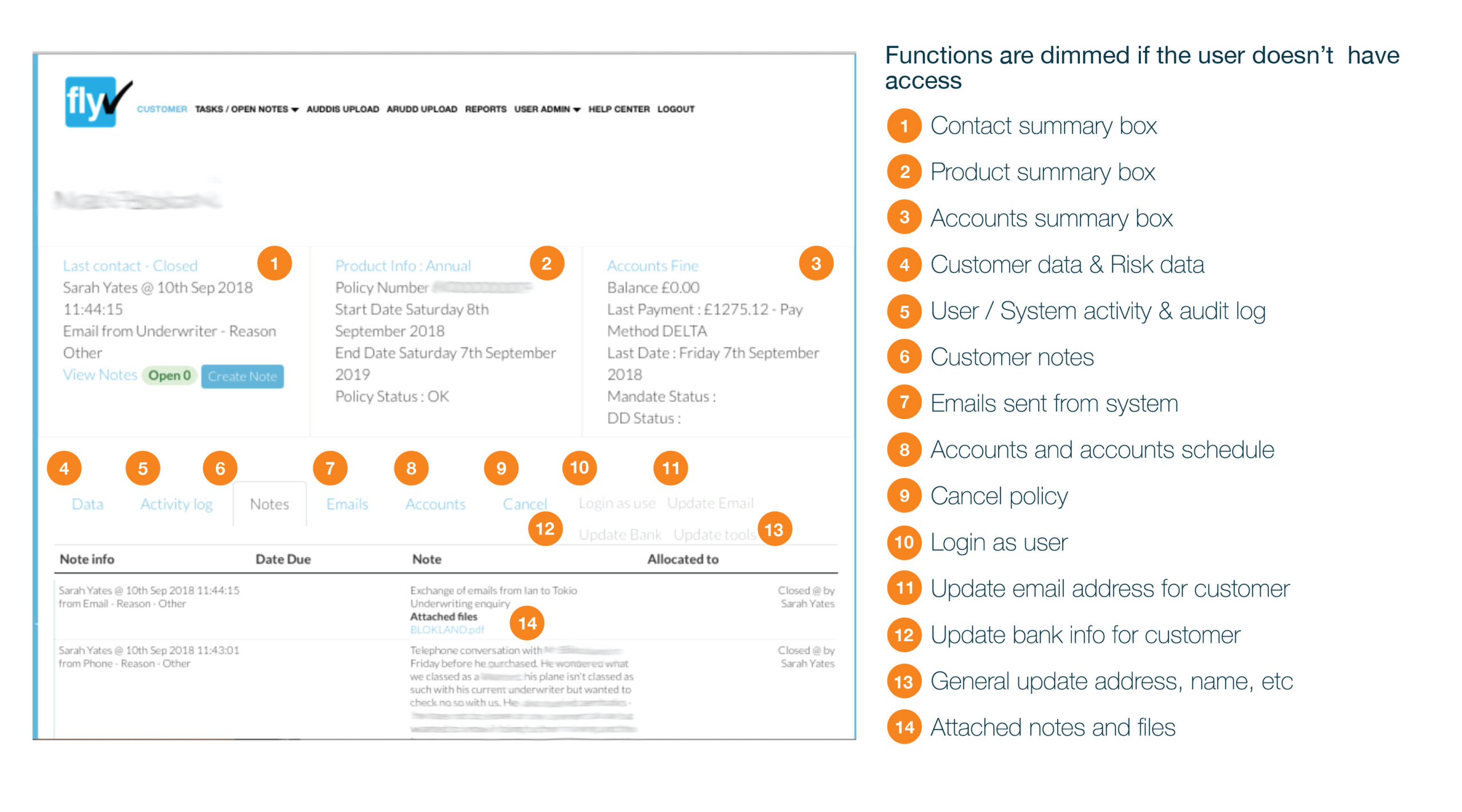

Broker CRM

FlyCovered

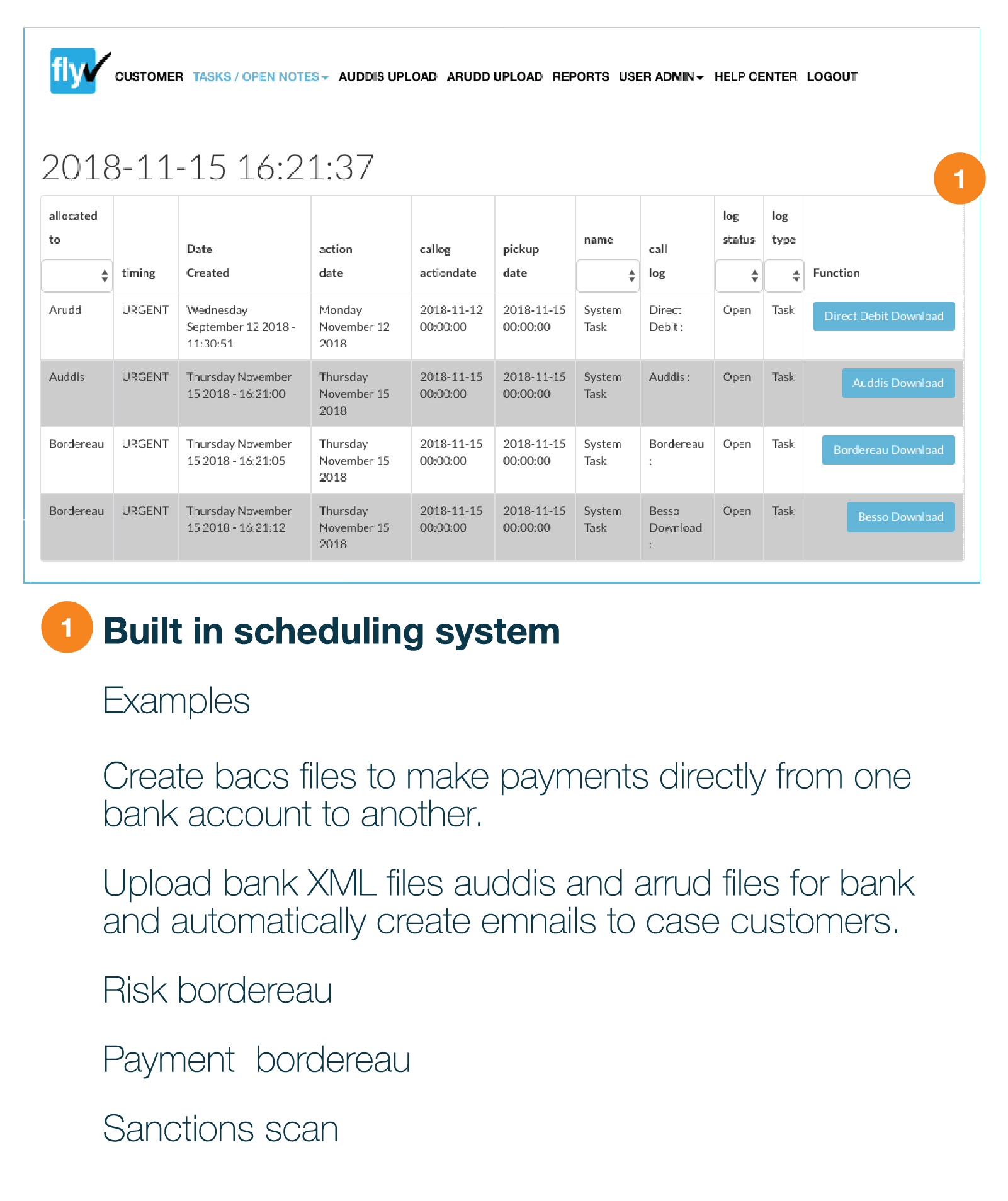

Backend System Task

FlyCovered

Backend user management

In-House Or Broker

Administration and CRM

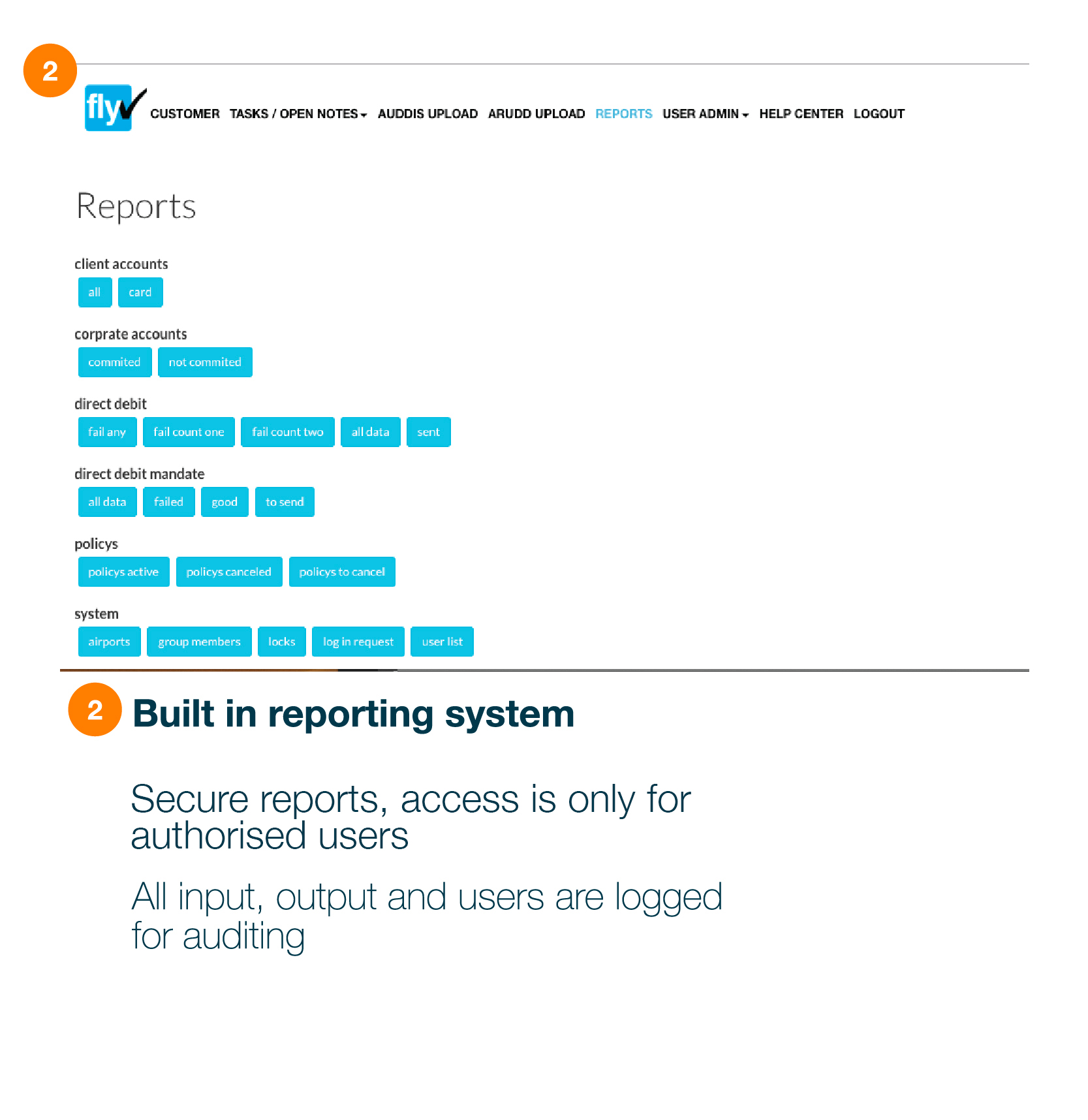

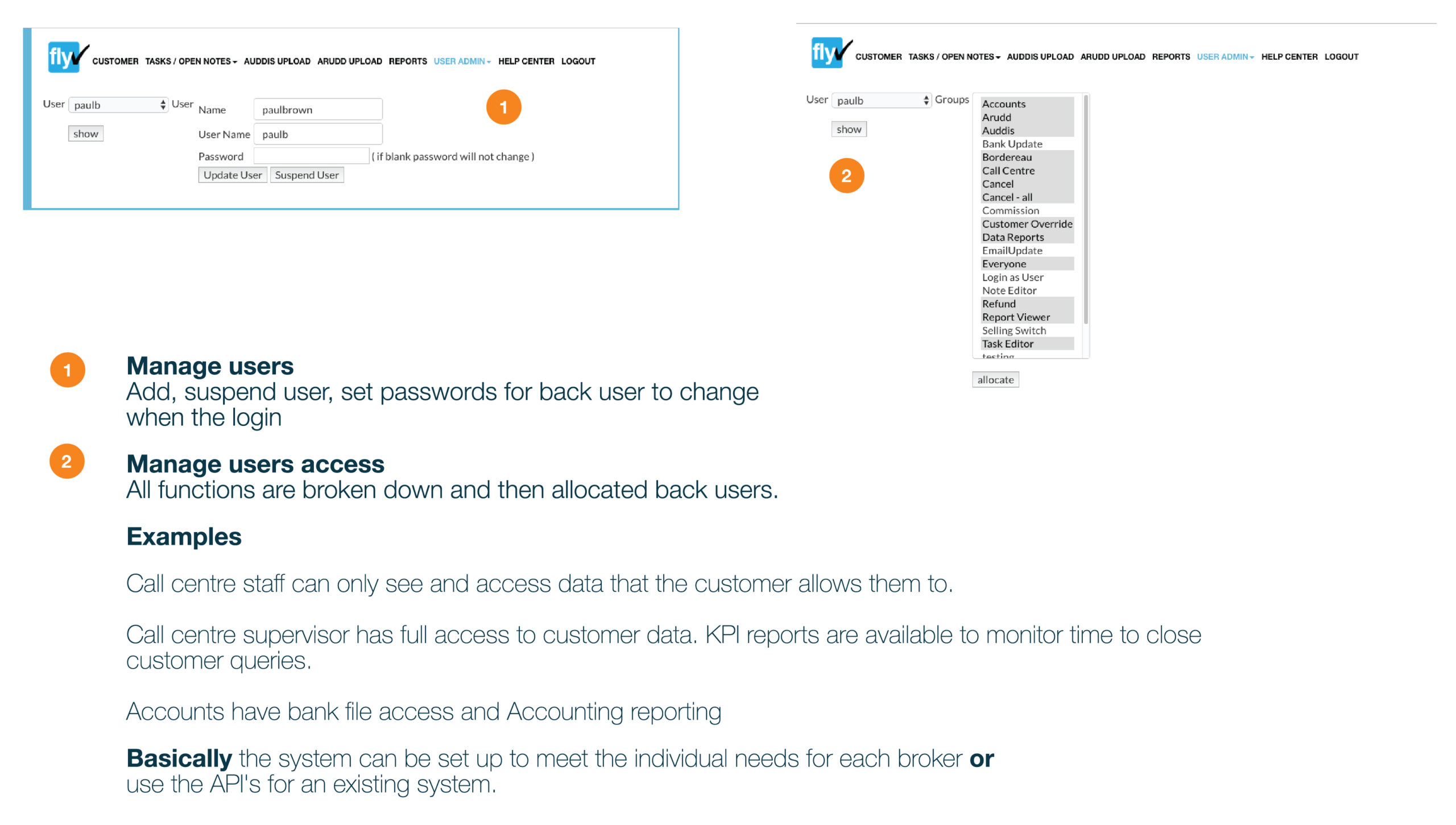

- The platform has a CRM that manages each customer, insurer BDX, Direct Debits and clientʼs policies.

- This is currently being used to manage aviation, drone, and motor products for brokers and insurers

- Brokers who want to differentiate themselves from competitors by improving an existing product or offering a new product in a dated market.

- The platform has been adopted by a leading insure to deliver Commercial Drone Insurance worldwide to its coverholder network.

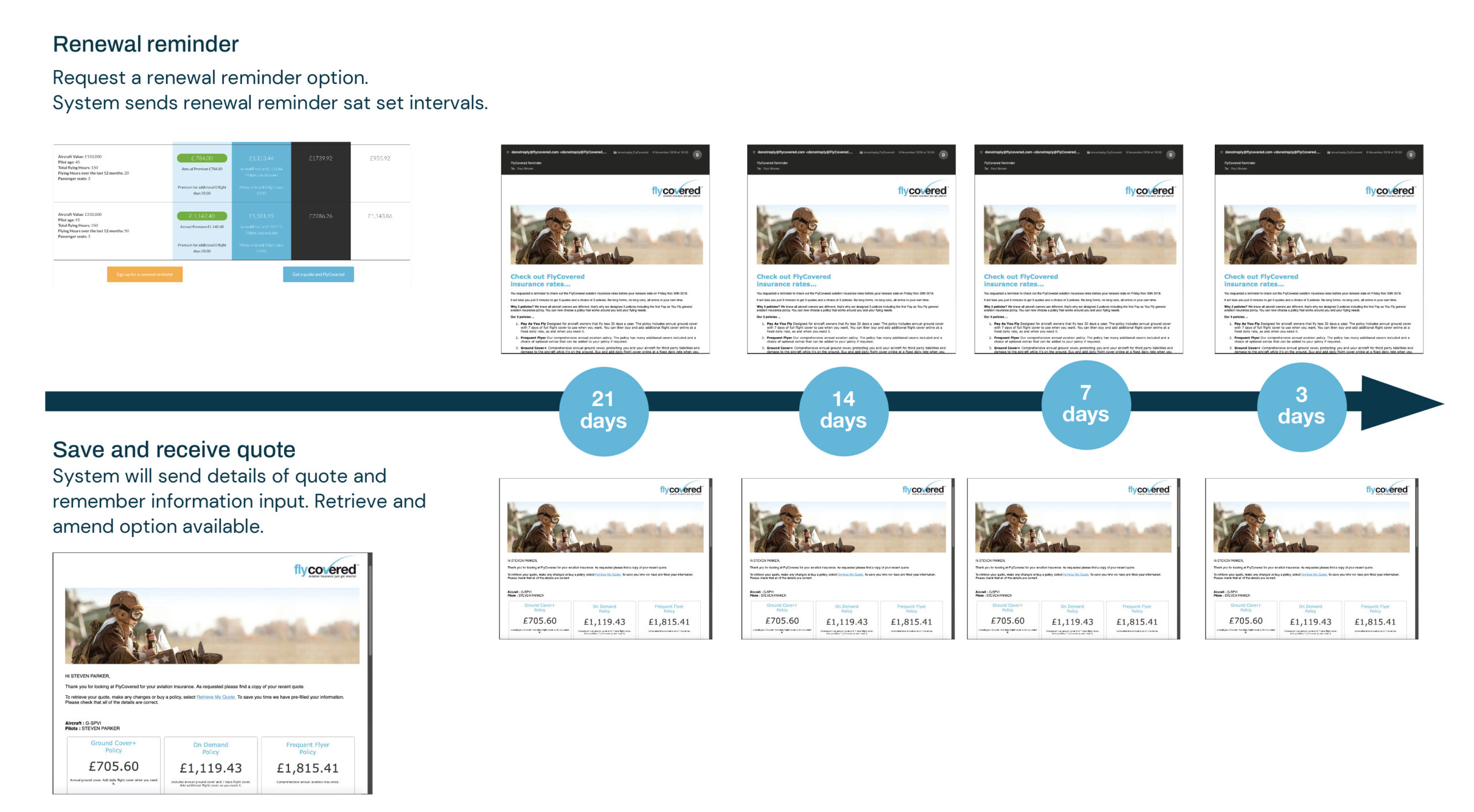

On-Demand policy options

Example:

Short-term policies: The customer selects a specific period of insured time, measured in hours or days 1 – 28. Followed by selecting the policy period they intend to use the insured days over this can be 1 to 90 days.

Extension Options: Both the insured time and policy period can be extended by buying additional days and adding to their online account as needed.

Annual On Demand policies:

The customer purchases an annual policy that has a set number of fully insured days included and placed in their account, they draw down the days when full cover is required over and above the basic annual cover provided.

Extension Options: Addition fully insured days can be purchased at a set rate and added to their account when the original days included in the policy have been used.

Our On-Demand Pillars

1. Pre book cover or switch on when needed

Peace of mind, budget

Current Live Insurance Sectors

Motor

We were the first and still the only company to offer PAYGO Learner driver insurance.

General Aviation

Worldʼs first (and still the only) PAYG general aviation policy. No other company offers this type of policy in aviation.

Pay As You Go and annual commercial drone insurance.

Live Examples From existing drop downs

FlyCovered ™

Drone and General Aviation

The First On-Demand General Aviation Insurance and UAS insurance that covers the insured aircraft or UAS 24/7 For the first time aircraft and UAS policyholders can avoid paying for flight cover when their aircraft or UAS is not in the air.

Rollover Unused Insured Flying Days

An exclusive advantage for your customers and a loyalty tool during renewal, available only on our platform. Policyholders have the option to carry over up to 7 unused Insured Flying Days when they renew their policy with you.

Cancel Insured Flying Days

The platform uses a unique credit system as things change it allows the insured to cancel booked Insured Flying Days and then credit their On-demand account with those days.

Price Cap Guarantee

Not everyone may be ready for On-Demand Insurance, but for those who choose it, we want to emphasize the potential savings. The platform gives you the option of selecting either On-Demand or annual coverage. The key benefit is that, regardless of the number of Insured Flying Days you purchase, the cost will never exceed that of our traditional Annual policy. This gives customers flexibility and savings without the risk of paying more than they would with a standard annual insurance policy.

Covered On-Demand ™

Introducing the Next Generation in Learner Driver Insurance

Discover simplicity with our revolutionary On-Demand Learner Driver Insurance. Say goodbye to wasted money and hello to flexibility that fits your lifestyle and budget.

Why choose us?

• Pay as You Drive: You only pay for the days you’re behind the wheel, saving you money when you’re not.

• Smart Management: Take control with our easy online policy management. Book Insured Days when both the car and a supervisor are available.

• Top-Up Options: Need more driving time? No problem. Buy additional driving days or extend your policy days at your convenience.

• Tailor-Made Policies: Build a policy that suits your life. Start small and expand as you go, purchasing additional days when you need them.

Join the future of learner driver insurance. Drive smart, save money, and take control of your journey towards confident driving.

Target markets for Covered PAYGO

The platform can be used in any number of sectors where a market exists for PAYG /Episodic insurance.

It provides an alternative to annual policies for high value low use items. Also where short-term cover offers more value and connivance to the customer.

The platform can also offer solutions for the sharing and gig community.

Annual or PAYGO. TPF&T in the garage. Turn on Fully Comprehensive when you need it. Laid Up Cover

Motorbikes

Annual and PAYGO policies for the classic bike and only when its sunny riders. TPF&T in the garage. Turn on Fully Comprehensive when you need it.

Short-term motor

PAYGO. Borrow a car, test drive, share the drive.

Public liability,Professional indemnity,Business equipment

PAYGO and Annual policies for freelancers and contractors

Host Insurance

PAYGO and Annual cover for the home-sharing sector.

Annual and PAYGO policies. Van, Car, Motorbike, Cycle, Electric Scooter.

Part-time Delivery

Annual and PAYGO policies. Van, Car, Motorbike, Cycle, Electric Scooter.

Horsebox

Annual and PAYGO policies. TPF&T on the drive turn on Fully Comprehensive when you need it.

Motor Home

Annual and PAYGO policies. TPF&T on the. drive, turn on Fully Comprehensive when you need it.

Private Hire

Annual and PAYGO polices, Turn on commercial cover when working.

Why Consider Covered On Demand Tech?

Proven Track Record:

Successfully delivered over 10,000,000 hours of On-Demand insurance in the Motor & Aviation Sector.

Battle-tested and proven technology with a robust history of over 7 years.

On-Demand Transaction

Customer Satisfaction:

Over 150,000 policies sold, including 60,000 On-Demand policies.

Positive customer feedback and satisfaction evident in the volume of policies sold.

Reliability:

Unparalleled reliability no failures affecting policyholders cover

Dependable performance ensures a seamless experience for customers, brokers and insurers.

Compliance:

Fully compliant system with zero complaints filed regarding system delivery or product.

Adheres to industry standards, ensuring a secure and compliant environment.

Scalability and Security:

Highly scalable platform designed to accommodate growth.

PCI compliant, ensuring secure transactions and data protection.

Agile Product Development:

A streamlined process for adding new products, with lower costs and faster time-to-market.

System flexibility supports the incorporation of new products, ratings, and wordings.

Offers flexibility in pricing by linking with insurers to enable dynamic pricing.

Fixed or dynamic rating options to cater to different business models.

Versatile Distribution Channels:

Equipped for both wholesale and direct distribution, providing a versatile solution.

Capable of serving both brokers and direct customers effectively.

Underwriting Enhancement:

Facilitates underwriting enrichment by allowing insurers to integrate customer and underwriting scoring seamlessly.

Provides a comprehensive solution for refining underwriting processes.

User-Friendly Experience:

Self-service functionality empowers customers to manage policies online.

Accessible from various devices, including laptops, tablets, iPhones, and smartphones.

Instant Coverage and Documentation:

Ensures instant coverage with quick delivery of policy documents via email.

Streamlines the process, providing immediate access to critical policy information.

Elevate your customer interactions and differentiate your business by providing a seamless and personalized experience. Embrace innovation with us and redefine what’s possible for your customers.

Contact Us

Support

Copyright © 2023 Covered Insurance Services Ltd